Importance of Savings

June 11, 2021“Carrying an umbrella even if it is a pleasant day, is a good practice. A quick change in weather to heavy rain or scorching heat can happen at any point and that is where the umbrella can be of use”.

Money has become a primary driving factor across the globe irrespective of land, people, and culture. Over a span of last twenty years, the world has been witnessing economies undergoing significant changes. As economies grow; so, does the value of money and the needs of people. This is where the concept of savings takes the centre stage. Savings can be termed as the first step to financial planning for an individual.

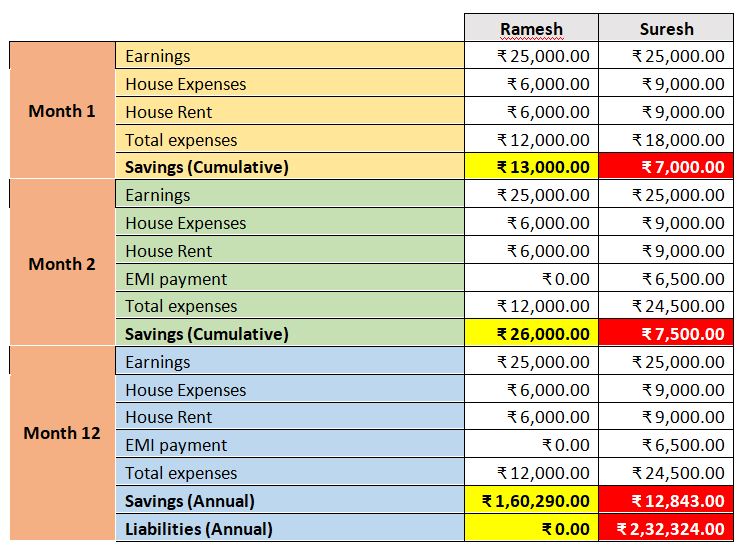

Let us peek into the lives of Ramesh and Suresh.

Ramesh is from a middle-class Indian family has a savings mind right from his childhood. He lands up in a job after education and starts saving his earnings in a bank. Suresh also comes from the same economic background. But unlike Ramesh; he is extravagant right from childhood and was not imbibed with the practice of savings. He ends up working in the same firm as Ramesh and draws the same salary.

Suresh decides to buy a superbike; puts a personal loan for 2 lakh rupees for a period of 3 years and ends up paying ₹6,500 as part of the EMI payment. After a year, we can see that his savings sums up to just ₹12,843 and is liable by ₹2,32,324. Now, if we see the case of Ramesh, he has been saving regularly in the bank and by the end of the year, he has saved around ₹1,60,290 and is debt-free.

This is the underlying statement in savings.

From the above illustration we can see that

- Savings should be developed at an early stage and should be the primary focus which provides stability to our own decisions.

- Saving money in a consistent manner helps us build the necessary corpus for attaining our goals.

- Bad financial foresight can lead to unwanted liability which will place us in an uncomfortable financial position.

So, we need to start practicing Savings as a baby step to our financial stability. The starting point for any financial activity in our life starts with SAVINGS. Even a single coin saved now can make gains in the future. You can ask if Savings alone is sufficient. The answer is ‘No’. That is where the next step comes in. We will see that in detail in the next article.